Unlock Up to 65% EV Charging Subsidies in Europe (2024 Guide for Germany, France, Spain)

Seizing the Golden Opportunity for EV Charging Subsidies in Europe

- Reduce infrastructure investment costs

- Ensure rapid regulatory compliance

- Secure premium charging locations

Tayniu Insight: With our overseas warehouses and adaptable products, Tayniu helps you efficiently align with European subsidy requirements.

Detailed Comparison of Subsidy Policies in Germany, France, and Spain

1. Germany: High Subsidies with Strict Technical Standards

- Home/Business Chargers: Up to €1,200 subsidy (when combined with solar/storage solutions, Tayniu Home AC Charger + Storage System is recommended).

- Highway Service Areas: 50% equipment cost subsidy (requirements: 150kW+ power, CCS2 standard).

Application Conditions: TÜV certification required, minimum 5-year operation commitment.

2. France: A Universal Model with a Focus on Rural Coverage

- Public Charging Stations in Towns: Mandatory for towns with 10,000+ residents, 40% subsidy for equipment and installation.

- Tourist Areas: Additional 20% subsidies for regions like Provence and the Alps.

Application Process: A government tender system and environmental impact assessment are required.

3. Spain: Investment Hotspot Driven by Tourism

- Urban Fast Chargers: Minimum of 2 stations per square kilometer in Madrid and Barcelona, with €3,000 per charger subsidy.

- Integrated Solar Charging: An additional 15% subsidy is recommended for solar-powered stations (Tayniu Solar-Storage-Charging Integrated Solution).

4. Comparative Table of Subsidy Policies

| Criteria | Germany | France | Spain |

|---|---|---|---|

| Maximum Subsidy Rate | 50% of equipment costs | 40% of total costs | 30%-45% (depending on scenario) |

| Approval Timeline | 3-6 months | Tender-based (4-8 months) | 2-4 months (green channel available) |

| Tayniu Advantages | Regulatory customization support | Flexible supply chain with EU warehouses | Direct subsidies for integrated solar-charging solutions |

Five Practical Strategies for Businesses Applying for Subsidies

- Target High-Subsidy Scenarios – Partner with key stakeholders in each country.

- Mitigate Compliance Risks – Use Tayniu’s free grid compatibility reports.

- Stack Multiple Subsidies – Combine federal, state, and EU grants.

- Accelerate Approval Processes – Leverage Tayniu’s standardized documentation.

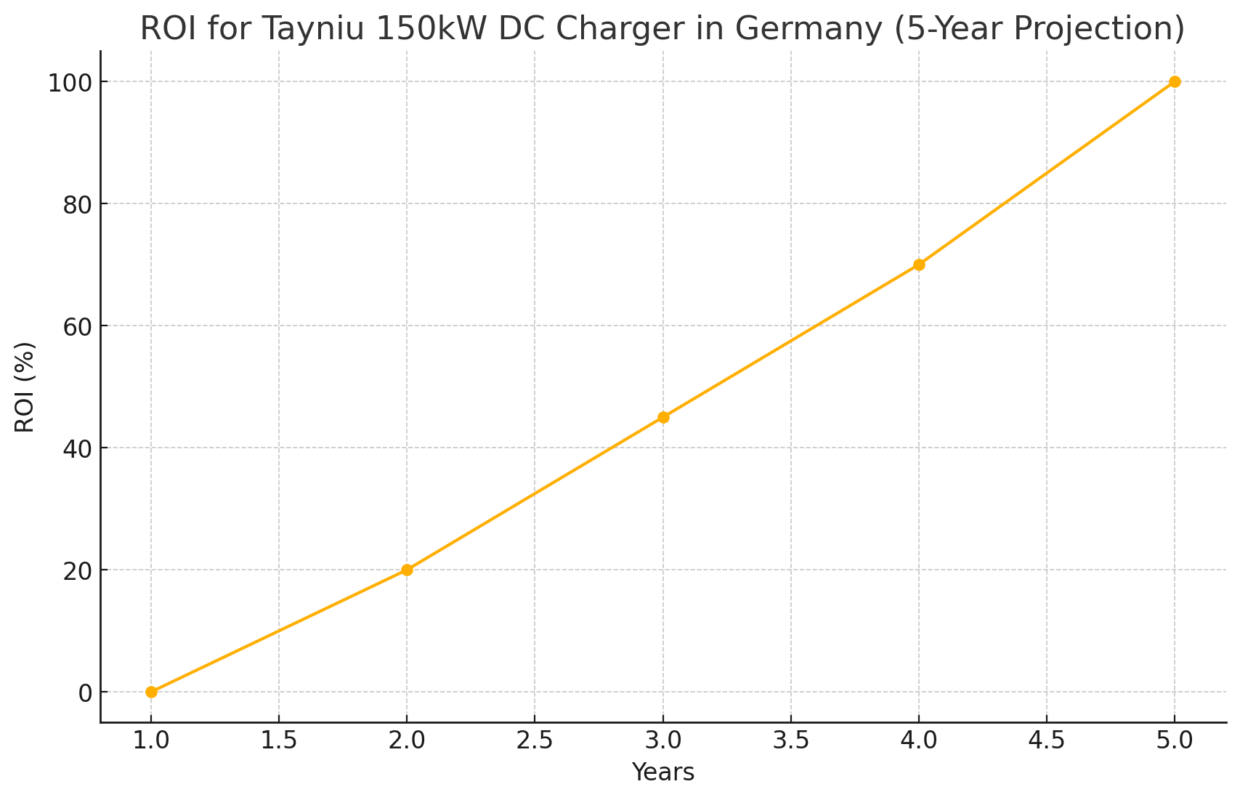

- Long-Term Profitability Analysis – Ensure ROI through smart investment planning.

Tayniu Solutions: Your Trusted Partner for European Subsidy Success

- Product Compliance Assurance: All chargers are pre-equipped with CCS2 interfaces, meeting AFIR mandates.

- Overseas Warehousing & Rapid Response: Faster project execution with EU-based logistics.

Success Stories

- Thailand EV Charging Network: Tayniu deployed charging stations across major Thai cities, improving infrastructure.

- Germany Public Car Park Chargers: Enhanced urban charging accessibility with efficient installations.

- Chile DC Charging Installation: Custom-designed and installed DC charging stations to support electric mobility.

Learn more about Tayniu’s engineering cases here.

Conclusion: Act Now to Secure Your Share of Europe’s 2024 EV Charging Boom

- Contact Tayniu’s European Policy Advisors for tailored subsidy strategies.

- Join our European EV Charging Investment Seminar (exclusive to corporate clients).

References:

- EU Regulations & Policies (AFIR, EV Subsidies): EU Funding & Tenders Portal

- Country-Specific EV Subsidy Programs: Spain’s Institute for Energy Diversification and Saving (IDAE)

- EV Industry Reports & Market Data: Transport & Environment (T&E) – EV Infrastructure Insights

- Renewable Energy & Solar Charging: SolarPower Europe

Last Updated on February 6, 2025 by tayniu